pag ibig regular savings dividend 2023|PBBM lauds Pag : Manila Pag-IBIG Fund sets aside at least seventy percent (70%) of its annual net income and credits it proportionately to its members’ Pag-IBIG Savings as dividends. This means that the more one has saved, the higher dividends that member shall earn. One of the world's leading online gambling companies. The most comprehensive In-Play service. Deposit Bonus for New Customers. Watch Live Sport. We stream over 100,000 events. Bet on Sportsbook and Casino.

pag ibig regular savings dividend 2023,Pag-IBIG Fund sets aside at least seventy percent (70%) of its annual net income and credits it proportionately to its members’ Pag-IBIG Savings as dividends. This means that the more one has saved, the higher dividends that member shall earn.

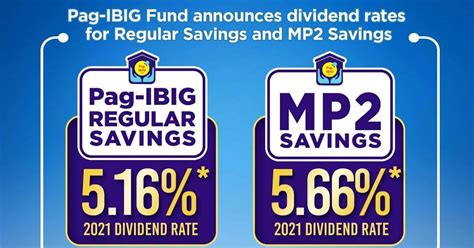

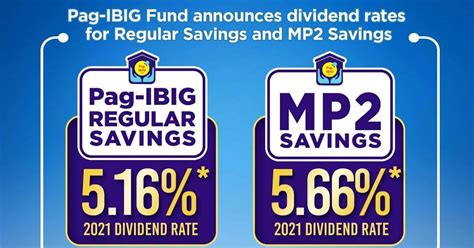

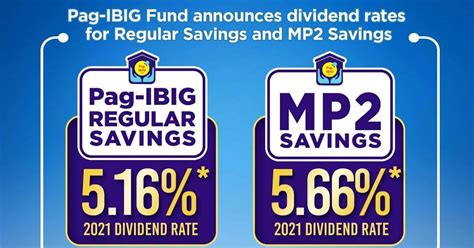

Your MP2 Savings earn annual dividends at a rate higher than the dividend rate of .Regular Savings; MP2 (Modified Pag-IBIG 2) Savings; Membership for Overseas .pag ibig regular savings dividend 2023 The dividend rate for the Regular Savings is at 6.55% per annum while MP2 sits at 7.05% per annum. How does it compare to 2022’s dividend rate? The 2023 . MANILA – The Pag-IBIG Fund on Tuesday said its regular savings dividend rate reached 6.55 percent and its Modified Pag-IBIG 2 (MP2) savings increased to 7.05 .For 2023, Pag-IBIG Regular Savings earned an annual dividend rate of 6.55 percent while the Modified Pag-IBIG 2 (MP2) Savings gained an annual return rate of 7.05 percent, . The Home Development Fund (Pag-IBIG Fund) chief executive Marlene Acosta announced that the dividend rate for Pag-IBIG slightly went up in 2023. The . Pag-IBIG chief executive officer Marlene Acosta said the dividend rate for regular savings is 6.55 percent, and 7.05 percent for the modified Pag-IBIG or MP2 .

Your MP2 Savings earn annual dividends at a rate higher than the dividend rate of the Pag-IBIG Regular Savings Program. Pag-IBIG Fund sets aside at least seventy percent .

Discover the benefits of Pag-IBIG Regular Savings program, including dividend earnings, savings accumulation, and housing loans. Start saving for your .

For 2023, Pag-IBIG Regular Savings earned an annual dividend rate of 6.55 percent while the Modified Pag-IBIG 2 (MP2) Savings gained an annual return rate of .

In the same manner, I hereby express my consent for Pag-IBIG Fund to collect, record, organize, update or modify, retrieve, consult, use, consolidate, block, erase or destruct my personal data as part of my information.It will however, keep earning dividends, based on the dividend rate of the Pag-IBIG Regular Savings for the next 2 years. After which, it shall stop earning dividends. 19 Can I withdraw my MP2 savings before its 5-year maturity Yes. You may pre-terminate and withdraw your MP2 Savings prior to its 5-year maturity, based on the following reasons:

For 2023, Pag-IBIG Regular Savings earned an annual dividend rate of 6.55 percent while the Modified Pag-IBIG 2 (MP2) Savings gained an annual return rate of 7.05 percent, both record-highs since .

As of 2022, 101,225 OFW members voluntarily save under Pag-IBIG Fund’s Modified Pag-IBIG 2 (MP2) Savings Program, where they earned 7.03% in dividend returns for the year. The Joint POEA- Pag-IBIG Fund Advisory released on April 21 reminds all OFWs to provide and encode their permanent Pag-IBIG Membership ID (MID) Numbers in their respective .Top-Up your Pag-IBIG Regular Savings; Save in the Pag-IBIG MP2 Savings; Pay your Pag-IBIG loans (Housing, Multi-Purpose, Calamity or Home Equity Appreciation Loan); Apply for Interest-Rate Repricing on your Housing Loan; Claim your Pag-IBIG Savings (due to membership maturity, optional withdrawal of savings, retirement at age 65, and . Discover the benefits of Pag-IBIG Regular Savings program, including dividend earnings, savings accumulation, and housing loans. . 2023 May 15, 2023 By Kuya Well 2 Comments on Pag-IBIG Regular Savings: . The yearly dividends of the regular Pag-IBIG savings program have a 5-year average rate of 6.47% which is .PBBM lauds Pag The Home Development Fund, or the Pag-IBIG Fund, has achieved its highest dividend rates since the Covid-19 pandemic began, as its regular savings dividend rate for 2023 reached 6.55 percent and its Modified Pag-IBIG 2 (MP2) Savings rate surged to 7.05 percent per annum.

MANILA – The Pag-IBIG Fund on Tuesday said its regular savings dividend rate reached 6.55 percent and its Modified Pag-IBIG 2 (MP2) savings increased to 7.05 percent in 2023.During the Chairman's Report at the Philippine International Convention Center in Pasay City, Pag-IBIG Fund chief.

The dividends of Home Development Mutual Fund, popularly known as Pag-IBIG Fund, post a slight uptick last year compared to the year 2022. During the Pag-IBIG Fund Chairman’s Report at the Philippine International Convention Center on Tuesday, President Ferdinand Marcos Jr. personally unveiled the 2023 . The Pag-IBIG Fund just released the dividend rate for 2022 a few hours earlier today. They touted it as the highest dividend rate since the Covid-19 Pandemic. What are the dividend rates for Regular Savings and MP2? The dividend rate for the Regular Savings is at 6.53% per annum while MP2 sits at 7.03% per annum.

President Marcos lauded Pag-IBIG Fund anew as the agency declared P48.76 billion in dividends to be distributed to its members as earnings on their savings in 2023, the highest in its 43-year history. For 2023, Pag-IBIG Regular Savings earned an annual dividend rate of 6.55 percent, while the Modified Pag-IBIG 2 (MP2) Savings .Qualified members can borrow up to 80% of their total Pag-IBIG Regular Savings, which consist of their monthly contributions, their employer’s contributions, and accumulated dividends earned. This means that the more you save in your Pag-IBIG Regular Savings, the higher loan amount you may apply for via the MPL. .Last updated April 20, 2023 . The provident benefit amount depends on the total contribution, the employer’s contribution, and the dividend earnings credited to the member’s fund. . The monthly deductions for .

Regular Savings; MP2 (Modified Pag-IBIG 2) Savings; Membership for Overseas Filipino Workers (OFWs) Housing Loan. Pag-IBIG Housing Loan; . Application for the Release of MP2 Annual Dividends: HQP-PFF-356 : V02: Request for Loyalty Card Enrollment Kiosk: HQP-PFF-123 : V03: Request for Consolidation/Merging of Member's Records: HQP .

For security reasons, you must log in to your Virtual Pag-IBIG Account to access your Pag-IBIG Fund savings and loan records. Continue. Enjoy Pag-IBIG Fund services anytime, anywhere with the Virtual Pag-IBIG! It's easy, it's convenient. It's your Lingkod Pag-IBIG 24/7. Be a Member. Pag-IBIG Fund has achieved its highest dividend rates since the Covid-19 pandemic, with its Regular Savings dividend rate for 2022 reaching 6.53 percent and its Modified Pag-IBIG 2 (MP2) Savings rate increasing to 7.03 percent per annum, Pag-IBIG Fund Chairperson and Department of Human Settlements and Urban Development . The Modified Pag-IBIG II or Pag IBIG MP2 is an optional savings scheme for members who want to save more and earn higher dividends on top of their regular Pag-IBIG savings.. The HMDF invests the funds collected from the Pag-IBIG MP2 mostly in its housing loan program, as well as its short-term loan programs.Funds grow through . Pag-IBIG Fund, the government agency that provides affordable housing loans to Filipino workers, has announced its highest dividend rates since the COVID-19 pandemic began. The Regular Savings dividend rate for 2022 reached 6.53%, while the Modified Pag-IBIG 2 (MP2) Savings surged to 7.03% per annum.

pag ibig regular savings dividend 2023|PBBM lauds Pag

PH0 · Regular Savings

PH1 · Pag

PH2 · PBBM lauds Pag

PH3 · Marcos lauds Pag

PH4 · MP2 (Modified Pag

PH5 · 2023 Pag